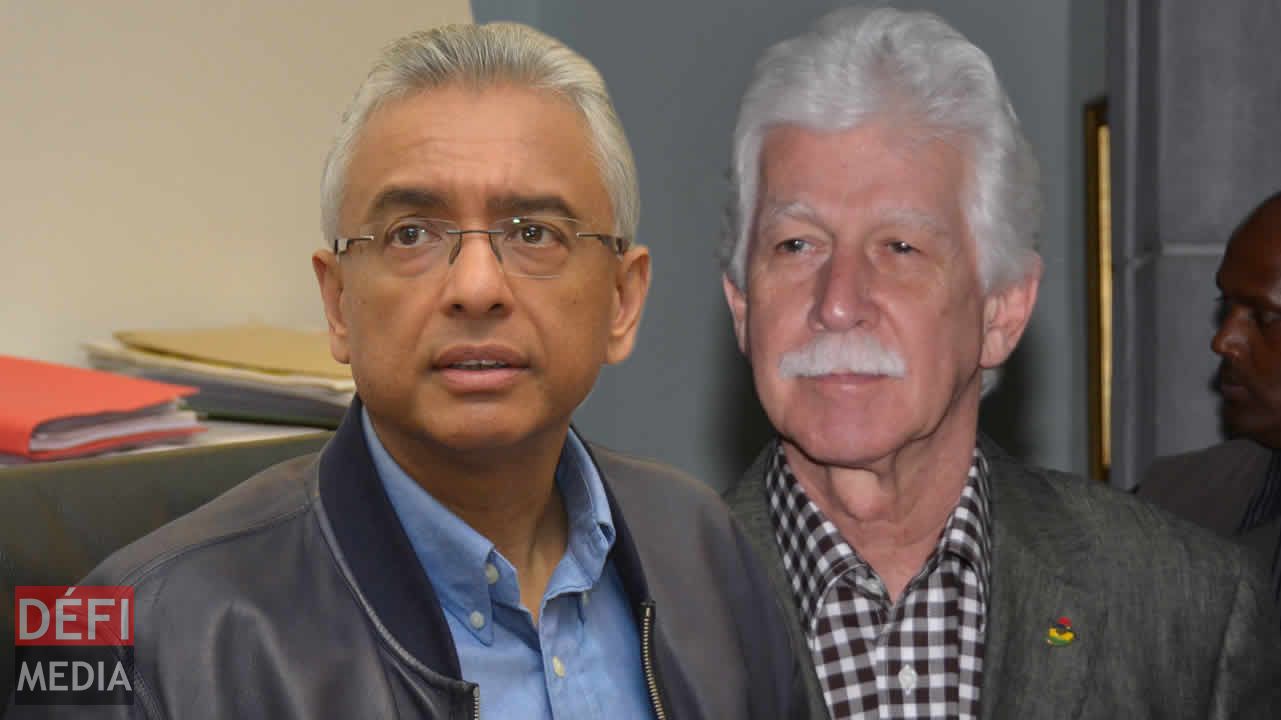

À l’Assemblée nationale mercredi 31 août, la Private Notice Question (PNQ), axée sur la reprise des activités de l’hôpital privé Apollo Bramwell par la firme britannique Omega Ark, a donné lieu à de vifs échanges entre le ministre des Finances Pravind Jugnauth et le leader de l’Opposition Paul Bérenger.

Publicité

Pravind Jugnauth a mis de côté sa diplomatie habituelle, répondu avec force et sévérité et a lancé une mise en garde à Paul Bérenger.

Paul Bérenger a réclamé une commission d’enquête, car il y a « quelque chose de louche » dans l’affaire Omega Ark qu’il qualifie de « deuxième MedPoint ».

Pravind Jugnauth a alors dénoncé la façon de faire de Paul Bérenger qui, selon lui, consiste à « jeter de la boue à ses adversaires ». Le ministre des Finances dit attendre la fin de son procès devant le Privy Council pour « régler ses comptes » à Paul Bérenger sur le dossier MedPoint.

Ci-dessous la réponse dans son intégralité de Pravind Jugnauth à l’Assemblée nationale mercredi 31 août :

PRIVATE NOTICE QUESTION

To ask the Honourable Minister of Finance and Economic Development –

Whether, in regard to Apollo-Bramwell Hospital, he will state -

(a) if the deed of sale of the assets thereof has been signed and if US $11m has been paid in respect thereof;

(b) the value of the outstanding pensions contribution, bank loans, suppliers and other commitments to be paid by NIC Health Care ltd;

(c) who decided to sell only the business, excluding the land and building, indicating the conditions of the sale of the business; and

(d) the results of his inquiry into the circumstances in which Omega Ark was registered and into the identity of the shareholders/directors thereof?

REPLY

Madam Speaker,

In the wake of the BAI collapse, the Apollo Bramwell Hospital was one of the assets of the Group which were put under administration. On the 7th August 2015, the Special Administrators of BAI Co. (Mtius) Ltd, Messrs Oosman and Basgeet of Price Waterhouse Coopers transferred the land and buildings of Apollo Bramwell Hospital to National Insurance Co. Ltd (‘NICL’), whilst the operations of Apollo Bramwell Hospital were transferred to NIC Healthcare Ltd (‘NICHL’), a wholly-owned subsidiary of NICL. The land and buildings were transferred from BAI to NIC at a book value of Rs 2.5 billion.

On 8th September 2015, NIC Healthcare Ltd appointed BDO & Co. as Transaction Advisor to identify a preferred bidder for the acquisition of the Apollo Bramwell Hospital. The objective was to obtain the maximum price for the policy holders, while protecting the employment of the hospital employees.

On 11th September 2015, an Expression of Interest (“EOI”) was published in local newspapers with a deadline for submission of application by 18th September 2015.

On 2nd October 2015, a ‘Request for Proposal’ was issued to all parties having responded to the EOI. Interested parties had the possibility to bid on the following six options, namely:

Option 1

Management contract AND

Outright acquisition of land & building

Option 2

Equity participation of <100% in the operations AND

Management contract AND

Outright acquisition of land & building

Option 3

Equity participation of 100% in the operations AND

Outright acquisition of land & building

Option 4

Management contract AND

Rental of land and building

Option 5

Equity participation of less than 100% in the operations AND

Management contract AND

Rental of land and building

Option 6

Equity participation of 100% in the operations AND

Rental of land and building

The deadline for submission of proposals was 19th October 2015 and, 12 proposals were received. After carrying out an evaluation of the technical and financial soundness of the proposals received, the Transaction Advisor shortlisted 3 applicants, as follows:

- Omega Ark Group PLC

- Lenmed Health Africa Ltd

- CIEL East Africa Healthcare Ltd

Omega Ark Group PLC had proposed the outright acquisition of operations and land and buildings subject to carrying out a detailed due diligence exercise.

LENMED Health Africa Ltd had proposed to acquire 75% of the operations for Rs 230 million and to rent the land and building at a rental to be agreed subject to the company being granted a right of first refusal to acquire the land and buildings in the event of a future sale. Furthermore, the company had proposed to retain only 400 employees.

As regard CIEL East Africa Healthcare Ltd, the company had proposed to acquire 100% of the operations for Rs 275m and to rent the land and buildings at a rental to be agreed subject to the company being granted an option to buy the land and buildings between Year 5 and Year 10. It is to be pointed out that the price of Rs 275 Million will be reduced by Rs 80 Million representing leased assets and is inclusive of stock valued at Rs 25 Million, bringing the net price to Rs 170 Million. Furthermore, that amount is payable conditional upon the future performance of the hospital. In addition, the company had proposed to retain only 500 employees.

Of these 3 shortlisted candidates, Omega Ark Group PLC was the only one to propose an outright purchase of the operations and the land and buildings. BDO recommended NIC Healthcare Ltd to, inter-alia, proceed in the following order :

First, to negotiate with Omega Ark on its employment strategy and to seek evidence of financial means;

Second, if negotiations with Omega Ark are not conclusive, to then negotiate with Lenmed Health Africa Ltd for an increase of its offer to 100% for the operations and to improve its employment proposal; and

Third, if the above fails to negotiate with CIEL East Africa Healthcare Ltd with regard to the quantum of the deferred consideration which should be paid upfront.

The Board of NIC Healthcare Ltd endorsed the recommendations of BDO and mandated the latter to proceed according to its recommendations.

Consequently, NIC Healthcare Ltd granted Omega Ark Group PLC the status of preferred bidder to allow BDO to start negotiations with the company. After obtaining clarification on the employment strategy and proof of funds, Omega Ark Group was given access to the hospital premises and records to enable it to carry out its due diligence exercise. After the exercise, Omega Ark Group Plc submitted its final offer for USD 60 Million (equivalent Rs 2.2 Billion).

Madam Speaker,

As regards part (c) of the question, Government on the 8th July 2016, took note that the outright sale of Apollo Bramwell would impact negatively on the accounts of the NIC and agreed to the land and buildings being leased.

Following that decision, NIC Healthcare Ltd negotiated with Omega Ark for the sale of the hospital business together with the leasing of the land and buildings.

There were still issues with regard to how the settlement of charges and encumbrances would be effected which remained outstanding.

Concerning part (b) of the question, the value of the outstanding pension contributions, bank loans, suppliers and other commitments to be paid by NIC Health care Ltd is Rs 638 Million.

Madam Speaker,

Regarding part (a) of the question, I am informed that Omega Ark has agreed to acquire the movable assets for a sum of USD 18 Million (Rs 650 Million) of which USD 11 Million is payable on the date of signature of the deed of transfer of the movable assets and the balance annually over a maximum period of 5 years or the date of sale of immovable properties, whichever is the earlier.

Moreover, Omega Ark will pay annual rent of USD 1.35 Million to NIC Healthcare Ltd for use of the immovable properties.

The deed of sale will be signed after all the conditions for the completion of the transaction have been fulfilled.

These conditions pertain to –

- Omega Ark receiving all the licences and permits to operate the hospital;

- New contracts of employment be signed by the employees;

- Tax losses be transferred in the name of Omega Ark Healthcare Investments Ltd; and

- Finalisation of the Lease Agreement and Notarial Deed for transfer of movable assets.

I am informed that the above conditions will be achieved shortly.

In the meantime, Omega Ark has advanced an amount of USD 225,000 (Rs 8 Million) to NIC Healthcare Ltd for the payment of salaries.

Madam Speaker,

Concerning part (d) of the question, I am informed as follows:

- Omega Ark Healthcare Investments Ltd was incorporated on 29 October 2015 in Mauritius by Omega Ark Group PLC to acquire Apollo Bramwell Hospital;

- According to the records at the Registry of Companies, the shareholder is Mr. Guy Anthony Rees;

- The Director is Mr Gooroodeo Sookun;

- I am informed that Mr. Vikram Katral is its ultimate beneficial owner;

- Omega Ark Group Plc Uk was incorporated in the United Kingdom on 22 June 2015, its shareholder is Omega Ark (HK) Limited;

- The current Directors are Mr. Vikram Katral (Chairperson) and Mr. Guy Anthony Rees;

- Omega Ark (HK) Limited, the ultimate holding company, was incorporated in Hong Kong on 02 February 2012;

- The name of the company on incorporation was Jaganmyee Brothers Trading Private Limited and on 06 February 2014, it was renamed Aasure Holding Limited and then on 02 February 2015, the name was changed to Omega Ark (HK) Limited; and

- The current shareholders and Directors of Omega Ark (HK) Ltd are Mr Rohit Kumar and Mr Vikram Katral.

Notre service WhatsApp. Vous êtes témoins d`un événement d`actualité ou d`une scène insolite? Envoyez-nous vos photos ou vidéos sur le 5 259 82 00 !