The Prime Minister and Minister of Finance announced a series of popular measures in the Budget 2019-2020 with the intent of improving the lives of Mauritians, irrespective of class or gender. Will these be really beneficial to everybody?

Publicité

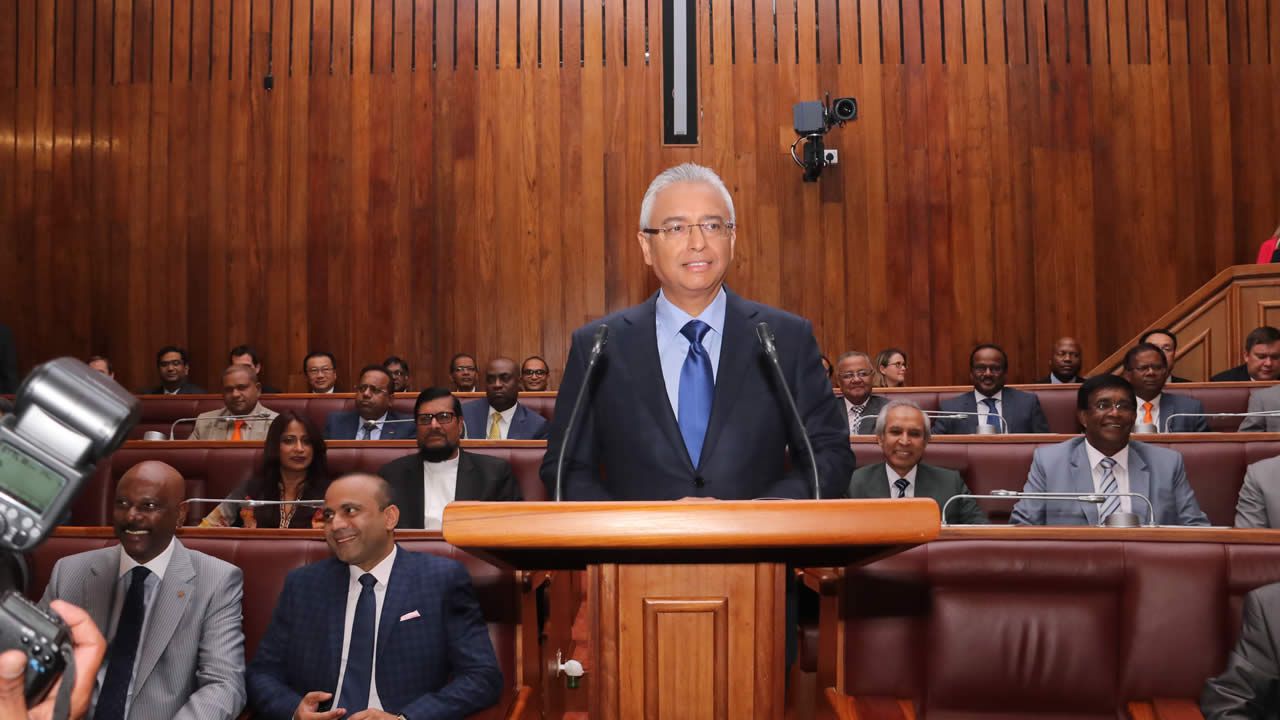

Presented on Monday 10th June by Pravind Jugnauth, the Budget 2019-2020, which charts out on ‘Ten Avenues to Embrace a Brighter Future Together as a Nation’, has known a mitigated welcome. Described as a social budget by some but criticized as not being up to the expectations on the financial and economic aspect, the Prime Minister and Minister of Finance has in fact announced various popular measures, namely on the social aspects with free internet access to needy families, extension of the Building Materials Grant Scheme, increase of old-age pension by Rs 500 as from January 2020, reduction of the price of mogas and diesel by Rs 3, VAT removed from food items such as on vermicelli and linseed, among others. Awaited with high expectations, will these measures have a major positive impact on the lives of the population? News on Sunday talks to stakeholders to have an insight on the aftermath effects of Budget 2019-2020.

Suttyhudeo Tengur : “These measures will help to build-up the ‘feel-good-factor’ of people”

The President of the Association for the Protection of the Environment and Consumers (APEC) trusts that the various popular measures announced by Pravind Jugnauth will be beneficial for the people at different levels. “Let’s start with the old-age pension, which will benefit more than 200,000 persons. If there are two pensioners in one home, i.e husband and wife, it means an additional revenue of Rs 1,000 monthly, which will contribute for the wellbeing of these persons,” says Suttyhudeo Tengur.

The President of the Association for the Protection of the Environment and Consumers (APEC) trusts that the various popular measures announced by Pravind Jugnauth will be beneficial for the people at different levels. “Let’s start with the old-age pension, which will benefit more than 200,000 persons. If there are two pensioners in one home, i.e husband and wife, it means an additional revenue of Rs 1,000 monthly, which will contribute for the wellbeing of these persons,” says Suttyhudeo Tengur.

Regarding the allocation of Rs 1,000 monthly to all public employees before the publication of the PRB Report scheduled in January next and also the increase of the ceiling of “exemption of tax,” he perceives these as optimistic. “It will directly have a positive impact on some 100,000 public servants, government, parastatal and other public bodies.” Moreover, he states that the reduction of the prices of domestic gas and of fuel, will also help to alleviate the burden on the people. “These will impact positively on the whole population because today, each and every house, with some rare exceptions, use gas for cooking and other purposes. These Rs. 500 plus Rs. 1,000, in addition to exemption from income tax and Rs. 30 less on domestic gas, will contribute to alleviate the burden on the pocket of the consumer.”

For measures such as the VAT removal food items such as vermicelli, ‘toukmaria’, linseed and others, Suttyhudeo Tengur utters that these will definitely improve the social well-being of the people. “These likely small measures will definitely impact on the social well-being of all categories of Mauritians and will help in the build-up of the ‘feel-good-factor’. As the economy is moving forward led by a booming construction sector, with employment going down, the social impact of these measures will be felt at all these different levels of the Mauritian strata.”

On the other hand, he states that these popular measures will have an influence on the coming elections. “All these measures will definitely have an impact on the forthcoming electoral campaign. As the country accounts for more than 600,000 voters, these measures will touch each and every one of them. It is a very subtle way to get people’s involvement and commitment as this Government is spearheading major infrastructural development like the Metro Express, the flyover at Phoenix and so many other major works throughout the country.”

Certainly, utters Suttyhudeo Tengur, “there will be some unhappy ones. But if you go around the island, you will take cognizance that people, especially, those at the lowest rung of the ladder, are happy, more so, that the prices of their ‘topette rum’ and cigarettes have not increased.”

Manisha Dookhony : “All these amount to higher expenditure capacity or savings”

The economist trusts that all the popular measures translate into an increase in the disposable income of Mauritians. “That means a family will end up with more money to spend on the products and services they need. Or it can also mean additional money being saved. If a family uses one gas cylinder per month, that represents a saving of Rs 30 and if the family currently spends about 80 L of Fuel per month, the reduction in excise duty on petrol and diesel means a saving of Rs 240. Already, the family has a saving of Rs 270. That means they could buy more than a kilo of chicken or extra fish or between 3 and 4 dozen eggs in one month,” explains Manisha Dookhony.

The economist trusts that all the popular measures translate into an increase in the disposable income of Mauritians. “That means a family will end up with more money to spend on the products and services they need. Or it can also mean additional money being saved. If a family uses one gas cylinder per month, that represents a saving of Rs 30 and if the family currently spends about 80 L of Fuel per month, the reduction in excise duty on petrol and diesel means a saving of Rs 240. Already, the family has a saving of Rs 270. That means they could buy more than a kilo of chicken or extra fish or between 3 and 4 dozen eggs in one month,” explains Manisha Dookhony.

Questioned about the economic impact of the grant of Rs 1,000 to civil servants, the economist states that the extra money could be used to pay for certain expenses. “A civil servant could use the money to pay for cinema tickets for his family, a visit to a private doctor or buy a much needed pair of glasses. This Rs 1,000 being an advance on the PRB then be lumped into the total amount paid. As such, if PRB in 2021 amounts to Rs 5,000, the effective increase in the revenue of the civil servant would be Rs 5,000 net of Rs 1,000 (being advance on PRB) and net of cumulative salary compensation since 2016. The advance, however, means that the civil servant gets the disposable income earlier. Over a year, the civil servant who decides to save that amount will end up with a total of Rs 13,000 and could buy two return flight tickets to Rodrigues.”

Moreover, Manisha Dookhony utters that the increase of Rs 500 for the old-age pension will have a positive economic impact on the lives of senior citizens. “A pensioner from the public sector whose work pension is indexed to the PRB is likely also to benefit from the prepayment although that needs to be clarified. That pensioner is likely then to get a total of Rs 1,500. With that amount, the pensioner can pay for electricity, water or phone bills.” The thresholds, she explains, “are interesting as all income brackets have an increase in exemption of Rs 5,000 except for those with two, three and four or more dependents. And more dependents relate to higher income exemptions, hence and indirect incentive to have more children!”

The economist trusts that “all these amount to higher expenditure capacity or a higher savings capacity of families. It will bring a little breathing space for those families who are very cash strapped.” Manisha Dookhony underlines that at the economy level, there has been a tendency to spur growth via increasing consumption. “We do have a very low inflation rate, which is very good, but we also have one of the lowest savings rate.

People are saving less and less of their income. Let us hope that they will instead choose to save some if not all of their income,” she states.

Measures announced

Economy

- Some 11,000 families, who are on the Social Register of Mauritius (SRM), will be given totally free access to Broadband Internet.

Public Sector Debt

- Pending the publication of the PRB Report which is due in January 2021, the Government will be providing for the payment of an interim monthly allowance of Rs 1,000 to all public officers as from 1st January 2020.

Ocean Economy

- The daily rate of bad weather allowance for fishermen will be increased from Rs 310 to Rs 340.

Infrastructure

- Taxi operators will benefit from a duty-free car every 4 years instead of 5 years.

- Reducing the Road Tax for vans, with up to 15 seats, used as school buses from Rs 3,000 to Rs 2,000 per annum.

Dwellings for families

- To meet the need of low-income families, 6,000 units will be constructed on 16 sites around the country over the next three years

- Review of the Building Materials Grant Scheme to provide significantly more support to families for the construction of their dwellings. For a family with monthly income of up to Rs 10,000, the maximum grant is being increased from Rs 65,000 to Rs 100,000.

- Extension of the scheme to families with monthly income above Rs 10,000 and not exceeding Rs 15,000. For these families, the grant will be up to Rs 70,000.

- For families with monthly income above Rs 15,000 and not exceeding Rs 20,000, the grant will be up to Rs 50,000.

- To raise the threshold value of bare land that a first time buyer may acquire, free of registration duty, to build a house. The exemption will apply on the first Rs 2.5 million of land value, provided the acreage does not exceed 20 perches.

- No registration duty will be payable on a secured housing loan for an amount not exceeding Rs 2.5 million

- Review of the eligibility criteria namely the upper limit for the cost of construction of a residence or the purchase price of an apartment is being increased from Rs 4 million to Rs 5 million and the household income threshold is being increased from Rs 2 million to Rs 3.5 million.

Social Aid

- Increase of the monthly carer’s allowance from Rs 3,000 to Rs 3,500 for some 23,000 bedridden pensioners.

- Extension of the eligibility for domiciliary visits of doctors to bedridden persons of 60 years and above.

- Increase of the annual grant to the Senior Citizens Council by Rs 500,000.

- Increase of Rs 500 on the monthly old age-pension as from January 2020, to bring the old age pension to Rs 6,710 per month.

- 5,000 families who are presently benefitting from Social Aid will be transitioned to the Marshall Plan Social Contract Scheme. These families will thus benefit from substantially higher support, under the SRM.

- Government will issue two Silver Bonds for the elderly to improve return on their savings and also for encouraging savings towards retirement. Bond holders will be paid interest once every quarter at a rate of 5.5% per annum. The bonds may be sold before maturity to the Government at par together with accrued but unpaid interest.

Gender Equality

- Removal of the restriction of the maternity leave on full pay limited to 3 confinements in the public service.

Child Protection and Welfare

- To improve care and support to new born children, there will be an increase of the existing monthly social aid benefit in the case of multiple births, from Rs 2,275 to Rs 2,500.

Taxation of Products

- Price of mogas reduced from Rs 47 per litre to Rs 44 per litre.

- Price of diesel reduced from Rs 38 per litre to Rs 35 per litre.

- Price of a 12 kg cylinder of cooking gas used by households reduced from Rs 240 to Rs 210.

- Provision of Rs 1.7 billion as subsidy to maintain the retail prices of rice, flour and LPG.

- VAT removed on vermicelli, toukmaria, linseed (graine de lin), sagoo, appalam, mustard seed and sesame seed.

Income Tax

- Increase of the income exemption thresholds for all categories of taxpayers for the income year 2019-2020: for a taxpayer who has no dependent or one dependent, the threshold will increase by Rs 5,000; for a taxpayer with two dependents, the threshold will increase by Rs 20,000; for a tax payer with three dependents, the threshold will increase by Rs 25,000; and for a taxpayer who has four dependents, the threshold will increase by Rs 45,000.

- Additional deduction for a child pursuing tertiary studies and relief for medical insurance premium will now be available for a maximum of 4 dependents instead of 3 dependents.

- Additional income tax exemption of Rs 50,000 will be granted to a retired or disabled person having more than one dependent

Notre service WhatsApp. Vous êtes témoins d`un événement d`actualité ou d`une scène insolite? Envoyez-nous vos photos ou vidéos sur le 5 259 82 00 !